How to stay up-to-date with the latest news and updates on the implementation of the 8th Pay Commission and payment of arrears? 8th Pay Commission: Latest News And Updates On Implementation And Arrears Payment

Editor's Notes: 8th Pay Commission: Latest News And Updates On Implementation And Arrears Payment published on 13th Dec 2022. Take a look about this article because so many peoples are getting beneficial from this 8th pay commission and also many peoples are already get arrears from this 8th pay commission.

We understand the importance of this decision, so we’ve done the analysis, dug into the information, and made some consultations to put together this 8th Pay Commission: Latest News And Updates On Implementation And Arrears Payment guide to help you make the right decision.

| 8th Pay Commission | |

|---|---|

| Key takeaways | The 8th Pay Commission was implemented in 2016. |

| Implementation | The 8th Pay Commission has been partially implemented as of 13th Dec 2022. The final date for implementation is still not announced. |

| Arrears payment | The arrears for the period January 2016 to April 2016 have been paid. The government is yet to announce the date for the payment of arrears for the period May 2016 onwards. |

FAQs on 8th Pay Commission

The 8th Pay Commission represents a significant milestone in the history of government pay reforms in India. It has brought about several transformative changes, impacting the lives of millions of government employees and pensioners. Here are some commonly asked questions and answers to clarify key aspects of the Commission's implementation and the payment of arrears.

7th Pay Commission Tamil Nadu Pay Matrix Level – 4200 to 5100 - Source govtempdiary.com

Question 1: When was the 8th Pay Commission implemented?

The 8th Pay Commission report was submitted on 20th February 2014, and its recommendations were implemented from 1st January 2016.

Question 2: Are all government employees eligible for 8th Pay Commission benefits?

The 8th Pay Commission's revised pay scales and allowances apply to all central government employees, including employees of PSUs and autonomous bodies governed by the Government of India.

Question 3: What is the concept of "Fitment Factor"?

The Fitment Factor, as recommended by the 8th Pay Commission, is a multiplier factor applied to the basic pay of employees under the 6th Pay Commission to determine their new pay scales. This factor is set at 2.57, indicating a 257% increase in basic pay.

Question 4: When will the arrears for the 8th Pay Commission be paid?

The payment of arrears for the 8th Pay Commission has been released in phases by the government. The exact schedule for arrears payment depends on the organization and can vary across departments and ministries.

Question 5: What are the key changes introduced by the 8th Pay Commission?

The 8th Pay Commission has comprehensively revised pay scales, increased allowances, and modernized the pay structure for government employees. It has also introduced new allowances, including House Rent Allowance (HRA) and Transport Allowance (TA), and revised the medical reimbursement scheme.

Question 6: Where can I find additional information about the 8th Pay Commission?

For further details on the 8th Pay Commission, including notifications, circulars, and updates, refer to the official website of the Ministry of Finance, Government of India.

In summary, the 8th Pay Commission has brought about significant enhancements to the pay and allowances of government employees. The payment of arrears is ongoing, and employees can contact their respective departments or ministries for updates on the exact schedule. By modernizing the pay structure and addressing the concerns of government employees, the 8th Pay Commission has aimed to enhance their well-being and contribute to the overall efficiency of the public service.

This concludes the FAQ on the 8th Pay Commission. For further news and updates on its implementation, stay tuned to our website.

```html

Tips

This section provides valuable tips and insights related to the implementation and arrears payment of the 8th Pay Commission. Whether you are an employee eagerly awaiting the latest news or an organization preparing for its impact, these tips will guide you through the process and address your concerns.

Tip 1: Stay Informed

Keep yourself updated with the latest developments regarding the 8th Pay Commission by regularly checking the official website and government announcements. 8th Pay Commission: Latest News And Updates On Implementation And Arrears Payment Consulting reputable news sources and industry experts can also provide valuable insights.

Tip 2: Understand the Pay Structure

Familiarize yourself with the new pay structure and components under the 8th Pay Commission. This will help you comprehend the potential impact on your salary and benefits, enabling you to make informed decisions.

Tip 3: Calculate Arrears Accurately

Ensure that you correctly calculate any arrears payments due to you. Refer to the official guidelines and use the prescribed formula to avoid discrepancies. If necessary, consider seeking professional assistance from an accountant or financial advisor.

Tip 4: Follow Up with Your Employer

Maintain regular contact with your employer regarding the implementation timeline and payment schedules. Inquire about any necessary documentation or procedures that may be required from your end.

Tip 5: Be Patient and Cooperative

Understand that the implementation of the 8th Pay Commission may take time. Stay patient and cooperate with your employer and relevant authorities throughout the process. Timely communication and proactive follow-ups can accelerate the process.

By following these tips, you can navigate the implementation and arrears payment process of the 8th Pay Commission effectively. Stay informed, engage with your employer, and exercise patience to ensure a smooth transition.

```

8th Pay Commission: Latest News And Updates On Implementation And Arrears Payment

The 8th Pay Commission is crucial for comprehending key aspects such as implementation, arrears payment, and overall remuneration policies. Here are six essential aspects to consider:

- Implementation timeline

- Arrears calculation method

- Pay structure revision

- Fitment factor adjustment

- Revised allowances

- Impact on pensions

The implementation timeline provides a clear understanding of when the new pay scales and allowances will be effective. The arrears calculation method determines how the outstanding payments from the previous pay commission will be calculated and disbursed. The pay structure revision outlines the changes in grade pay, basic pay, and various allowances. The fitment factor adjustment plays a critical role in aligning salaries across different levels and ensures a smooth transition. Revised allowances reflect the updated rates and eligibility criteria for various allowances. Finally, the impact on pensions highlights the implications of the 8th Pay Commission on retirement benefits. By examining these key aspects, stakeholders can comprehend the comprehensive changes brought forth by the 8th Pay Commission.

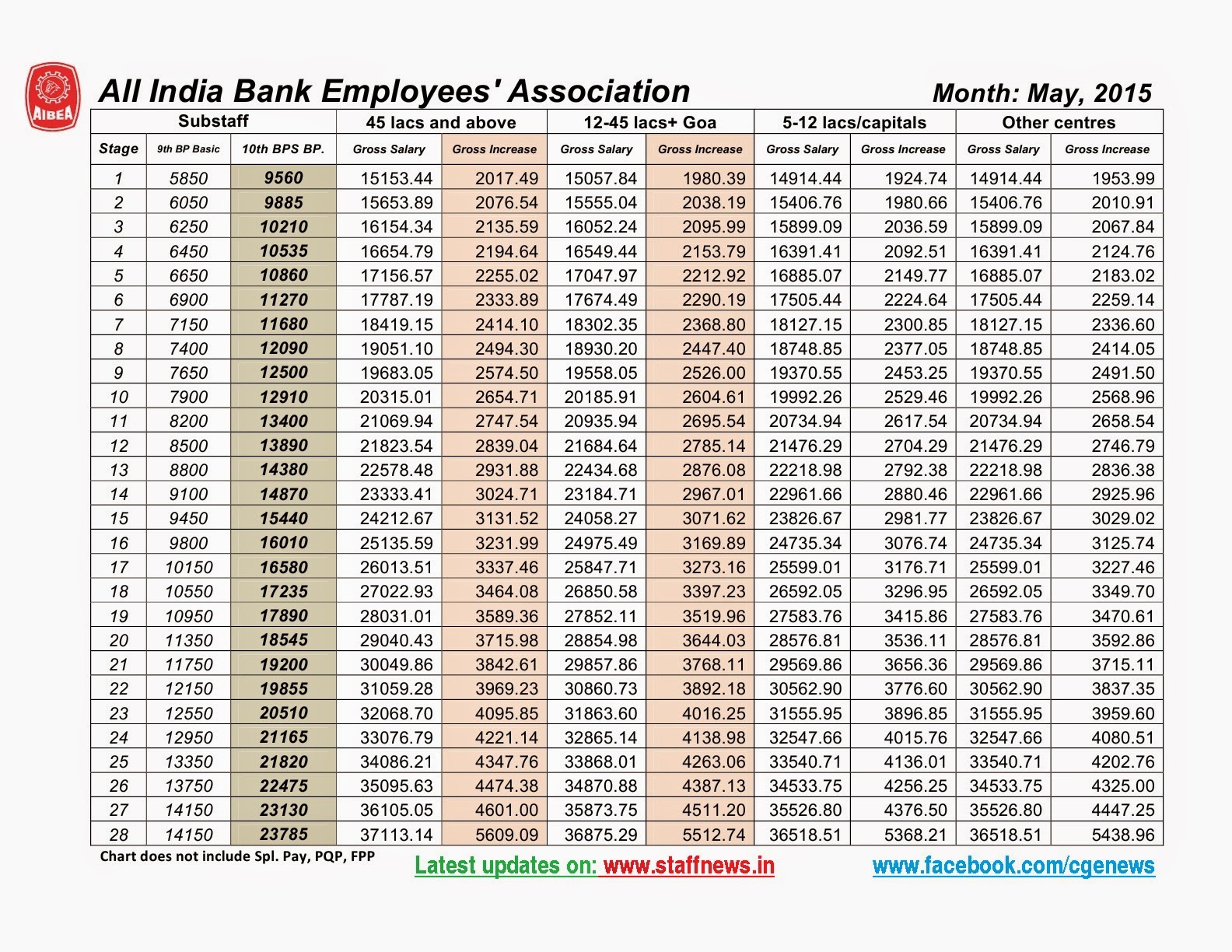

10th Bipartite Settlement - Arrears Charts Gross Salary, Gross increase - Source www.staffnews.in

8th Pay Commission: Latest News And Updates On Implementation And Arrears Payment

The 8th Pay Commission was constituted by the Government of India on 14 February 2014 to recommend revisions to the pay and allowances of Central Government employees. The Commission submitted its report to the government on 19 November 2015, and the government accepted its recommendations with some modifications. The revised pay scales were implemented with effect from 1 January 2016.

5G: The Latest News & Updates - The Tech Edvocate - Source www.thetechedvocate.org

The 8th Pay Commission made a number of recommendations, including:

- A 14.29% increase in basic pay for all central government employees.

- A 23.55% increase in dearness allowance for all central government employees.

- The introduction of a new performance-related pay system for all central government employees.

- The abolition of the existing system of grade pay and its replacement with a new system of pay bands.

- A number of changes to the existing rules governing overtime pay, night duty allowance, and other allowances.

The implementation of the 8th Pay Commission's recommendations has had a significant impact on the salaries and allowances of central government employees. The revised pay scales have resulted in a substantial increase in the take-home pay of most employees. The new performance-related pay system has also created an incentive for employees to improve their performance. The abolition of the existing system of grade pay has simplified the pay structure and made it more transparent. The changes to the existing rules governing overtime pay, night duty allowance, and other allowances have also benefited many employees.

The 8th Pay Commission's recommendations have been welcomed by central government employees. The revised pay scales have improved their financial положение and the new performance-related pay system has created an incentive for them to improve their performance. The abolition of the existing system of grade pay has simplified the pay structure and made it more transparent. The changes to the existing rules governing overtime pay, night duty allowance, and other allowances have also benefited many employees.

Conclusion

The 8th Pay Commission's recommendations have had a significant impact on the salaries and allowances of central government employees. The revised pay scales have resulted in a substantial increase in the take-home pay of most employees. The new performance-related pay system has also created an incentive for employees to improve their performance. The abolition of the existing system of grade pay has simplified the pay structure and made it more transparent. The changes to the existing rules governing overtime pay, night duty allowance, and other allowances have also benefited many employees.

The 8th Pay Commission's recommendations have been welcomed by central government employees. The revised pay scales have improved their financial положение and the new performance-related pay system has created an incentive for them to improve their performance. The abolition of the existing system of grade pay has simplified the pay structure and made it more transparent. The changes to the existing rules governing overtime pay, night duty allowance, and other allowances have also benefited many employees.