Pinjaman KUR BRI 2025: Panduan Lengkap Untuk Usaha Kecil Dan Mikro Permodalan usaha menjadi salah satu faktor penting dalam mengembangkan usaha kecil dan mikro. Salah satu solusi yang dapat menjadi pilihan adalah Kredit Usaha Rakyat (KUR) BRI.

Editor's Notes: KUR BRI 2025: Panduan Lengkap Untuk Usaha Kecil Dan Mikro telah terbit dengan tanggal hari ini. Pinjaman KUR BRI 2025: Panduan Lengkap Untuk Usaha Kecil Dan Mikro ini penting untuk dibaca karena memberikan informasi lengkap dan komprehensif tentang KUR BRI 2025, yang merupakan program pemerintah untuk membantu usaha kecil dan mikro dalam mengembangkan usahanya.

Setelah melakukan analisis dan menggali informasi dari berbagai sumber, kami telah menyusun Pinjaman KUR BRI 2025: Panduan Lengkap Untuk Usaha Kecil Dan Mikro ini untuk membantu Anda mengambil keputusan yang tepat.

Per differences or Key takeways, provide in informative table format>

| KUR Mikro | KUR Kecil | KUR TKI |

|---|---|---|

| Pinjaman hingga Rp 50 juta | Pinjaman mulai dari Rp 50 juta hingga Rp 500 juta | Pinjaman hingga Rp 25 juta |

| Bunga 6% per tahun | Bunga 7% per tahun | Bunga 6% per tahun |

| Tenor pinjaman hingga 3 tahun | Tenor pinjaman hingga 5 tahun | Tenor pinjaman hingga 3 tahun |

Transition to main article topics

Selain informasi di atas, Pinjaman KUR BRI 2025: Panduan Lengkap Untuk Usaha Kecil Dan Mikro ini juga membahas topik-topik penting berikut:

- Syarat dan ketentuan pengajuan KUR BRI 2025

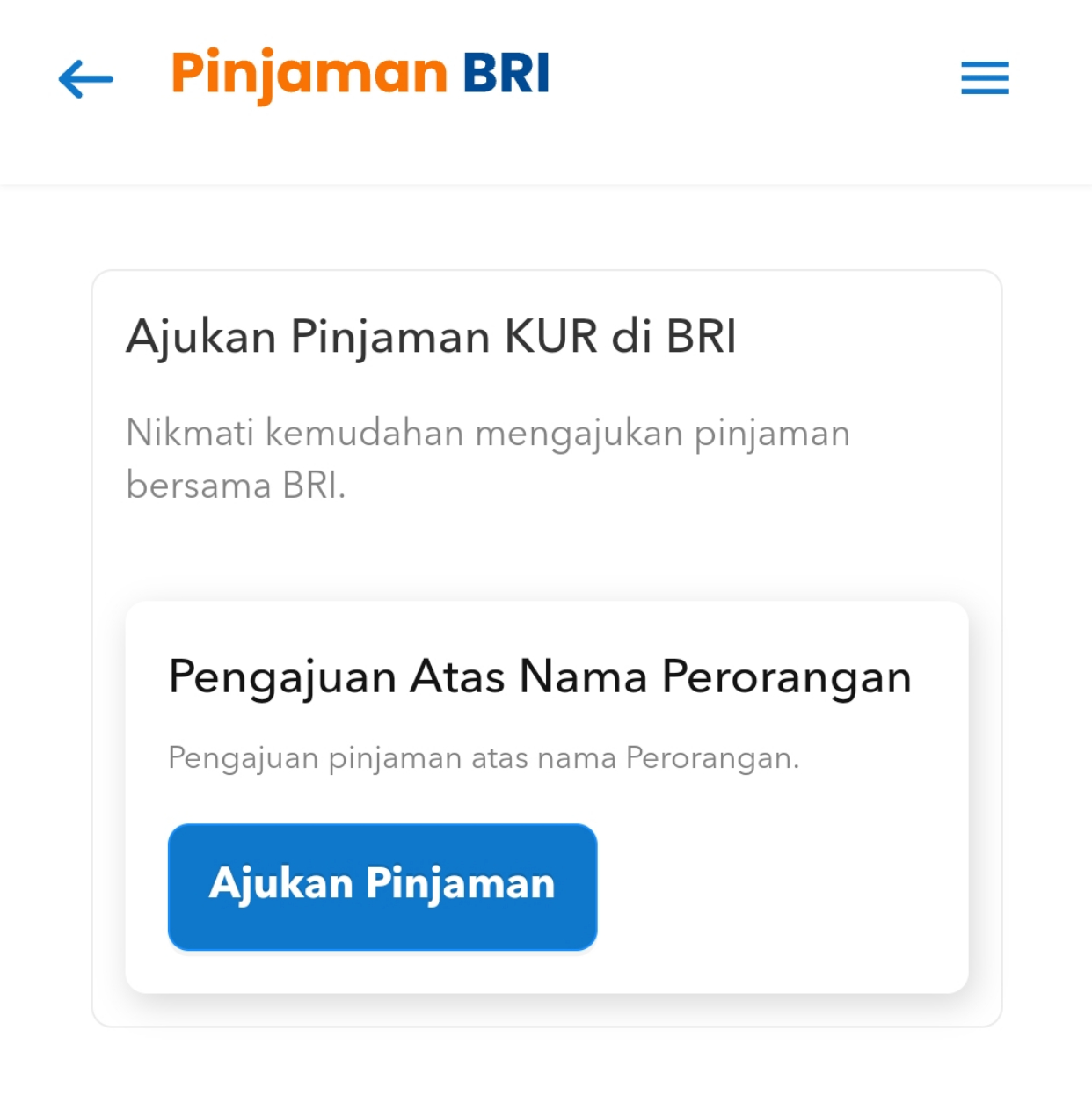

- Cara mengajukan KUR BRI 2025

- Tips mendapatkan KUR BRI 2025

- Penggunaan KUR BRI 2025

- Konsekuensi tidak membayar KUR BRI 2025

Dengan membaca Pinjaman KUR BRI 2025: Panduan Lengkap Untuk Usaha Kecil Dan Mikro ini, Anda akan mendapatkan pemahaman yang komprehensif tentang KUR BRI 2025 dan dapat menentukan apakah program ini tepat untuk usaha Anda.

Kami harap Pinjaman KUR BRI 2025: Panduan Lengkap Untuk Usaha Kecil Dan Mikro ini bermanfaat untuk Anda. Jika Anda memiliki pertanyaan atau membutuhkan informasi lebih lanjut, jangan ragu untuk menghubungi kami.

Frequently Asked Questions: Pinjaman KUR BRI 2025

To provide comprehensive information about the KUR BRI 2025 loan scheme, we have collated a list of frequently asked questions to address common concerns and clarify key aspects of the program. These questions and answers aim to equip micro and small businesses with the necessary knowledge to make informed decisions regarding their financing options.

Question 1: What is the purpose of the KUR BRI 2025 loan scheme?

The primary objective of the KUR BRI 2025 loan scheme is to provide financial support to micro and small businesses in Indonesia. It aims to stimulate economic growth by enabling these businesses to access affordable financing for their operations, investment, and expansion.

Panduan Pinjaman KUR BRI 2023 untuk Modal Usaha hingga Ratusan Juta - Source radartasik.disway.id

Question 2: Who is eligible to apply for a KUR BRI 2025 loan?

To be eligible for a KUR BRI 2025 loan, businesses must meet specific criteria, including being a micro or small business registered in Indonesia, having a clear business plan and financial statements, and satisfying the creditworthiness assessment conducted by BRI.

Question 3: What are the interest rates for KUR BRI 2025 loans?

The interest rates for KUR BRI 2025 loans vary depending on the loan amount and the type of business. However, they are generally lower than commercial lending rates, making them an attractive option for micro and small businesses seeking affordable financing.

Question 4: What is the maximum loan amount available under the KUR BRI 2025 scheme?

The maximum loan amount available under the KUR BRI 2025 scheme depends on the type of business and its financial needs. However, the scheme offers flexible loan amounts tailored to the specific requirements of micro and small businesses.

Question 5: What are the repayment terms for KUR BRI 2025 loans?

KUR BRI 2025 loans typically have flexible repayment terms that are determined based on the loan amount, business type, and cash flow projections. The repayment schedule is structured to ensure that businesses can comfortably meet their obligations while promoting sustainable growth.

Question 6: How can businesses apply for a KUR BRI 2025 loan?

Businesses can apply for a KUR BRI 2025 loan by visiting their nearest BRI branch. They will need to submit a completed application form along with the required supporting documents, such as business registration documents, financial statements, and a business plan.

We encourage micro and small businesses to explore the KUR BRI 2025 loan scheme and consider its potential benefits for their operations and growth. By providing comprehensive information and addressing common concerns, we aim to empower businesses in Indonesia with the knowledge and resources they need to succeed.

To learn more about the application process and eligibility criteria, visit the official BRI website or consult with a BRI loan officer at your nearest branch.

Tips

To secure a successful application of KUR BRI 2025, prospective borrowers are advised to adhere to the following guidelines:

Tip 1: Business Plan Preparation

Developing a comprehensive business plan is crucial for presenting lenders with a clear roadmap of the company's operations, financial projections, and growth strategies. Ensure that the plan is well-researched, realistic, and aligned with the objectives of the loan application.

Tip 2: Maintaining Good Financial Records

Lenders prioritize applicants who maintain accurate and up-to-date financial records. This demonstrates a commitment to financial discipline and facilitates the assessment of the business's financial performance and stability.

Tip 3: Building a Strong Credit History

A positive credit history reflects the company's ability to manage debt responsibly. Before applying for the loan, consider obtaining a credit report to identify any potential issues that may need to be addressed.

Tip 4: Seeking Professional Guidance

Consult with accountants or financial advisors who can provide insights into the loan application process and assist with business plan development. Their expertise can significantly improve the chances of application approval.

Tip 5: Adherence to Loan Requirements

Carefully review the loan requirements outlined by the lending institution. Ensure that the business meets all eligibility criteria, including those related to industry, revenue, and collateral.

Tip 6: Punctual Loan Repayments

Establishing a record of punctual loan repayments enhances the company's creditworthiness and increases the likelihood of loan approval in the future. It also helps maintain a positive relationship with lenders.

By implementing these tips, prospective borrowers can strengthen their application and increase their chances of securing the necessary funding through KUR BRI 2025 for their business ventures.

KUR Loan BRI 2025: A Comprehensive Guide for Micro and Small Enterprises

This comprehensive guide presents essential aspects of KUR BRI 2025, a crucial loan product for micro and small enterprises aiming to navigate the 2025 business landscape.

- Eligibility Criteria: Establish clear conditions for qualifying applicants.

- Loan Terms: Outline interest rates, repayment periods, and collateral requirements.

- Application Process: Provide step-by-step instructions for submitting an application.

- Disbursement Timeline: Explain the process and estimated time frame for receiving loan funds.

- Loan Utilization: Specify eligible business purposes and restrictions on loan usage.

- Repayment Flexibility: Highlight options for flexible repayment plans to ease financial burdens.

These key aspects collectively provide a comprehensive understanding of KUR BRI 2025, enabling micro and small enterprises to make informed decisions and access essential financing for business growth. By carefully considering these elements, businesses can position themselves for success in the coming years.

Tabel Pinjaman BRI 2025 Umum Panduan Lengkap - 2025 - Source 2025.co.id

Pinjaman KUR BRI 2025: Panduan Lengkap Untuk Usaha Kecil Dan Mikro

The Kredit Usaha Rakyat (KUR) is a loan program provided by BRI specifically for Micro, Small, and Medium Enterprises (MSMEs) in Indonesia. The KUR BRI 2025 program is a continuation of the government's efforts to support the growth and development of MSMEs in the country. This comprehensive guide provides detailed information about the KUR BRI 2025 program, including eligibility criteria, application procedures, and loan terms.

Tabel Pinjaman KUR BRI 2024: Panduan Lengkap Pinjaman - infinID - Source www.infinid.id

The KUR BRI 2025 program offers several advantages for MSMEs, including low-interest rates, flexible repayment periods, and a simplified application process. MSMEs can use the KUR BRI 2025 loan to finance various business activities, such as working capital, equipment purchases, and business expansion. The program is designed to support MSMEs in overcoming financial challenges and achieving sustainable growth.

To be eligible for the KUR BRI 2025 program, MSMEs must meet certain criteria, including having a valid business license, a good credit history, and a feasible business plan. The application process for the KUR BRI 2025 loan is relatively simple and can be completed through BRI branches or online platforms. MSMEs are required to submit a loan application form, financial statements, and other supporting documents.

The KUR BRI 2025 loan terms vary depending on the loan amount and the repayment period. MSMEs can choose from a range of loan amounts, starting from IDR 5 million up to IDR 500 million. The repayment period for the KUR BRI 2025 loan can range from 12 to 60 months. MSMEs are required to make regular monthly payments, and the interest rate is fixed throughout the loan period.

Key Features of KUR BRI 2025:

| Feature | Description |

|---|---|

| Loan Amount | IDR 5 million to IDR 500 million |

| Repayment Period | 12 to 60 months |

| Interest Rate | Fixed throughout the loan period |

| Eligibility | Valid business license, good credit history, feasible business plan |

| Application Process | Through BRI branches or online platforms |

The KUR BRI 2025 program is an important component of the government's efforts to support the growth and development of MSMEs in Indonesia. The program provides MSMEs with access to affordable financing, which can help them overcome financial challenges and achieve sustainable growth. The KUR BRI 2025 program is a valuable resource for MSMEs in Indonesia, and it is expected to continue to play a significant role in the development of the MSME sector in the years to come.

Conclusion

The KUR BRI 2025 program is a comprehensive and accessible loan program designed to support the growth and development of MSMEs in Indonesia. The program offers several advantages, including low-interest rates, flexible repayment periods, and a simplified application process. MSMEs can use the KUR BRI 2025 loan to finance various business activities and overcome financial challenges.

The KUR BRI 2025 program is a valuable resource for MSMEs in Indonesia, and it is expected to continue to play a significant role in the development of the MSME sector in the years to come. MSMEs are encouraged to explore the KUR BRI 2025 program and consider it as a potential source of financing for their business needs.