Retirement planning is a critical aspect of financial security, and "Retirement Payouts: Essential Guide For Pensioners" provides invaluable insights for those nearing or in retirement. This comprehensive guide addresses the complexities of retirement income and offers practical advice to help individuals make informed decisions.

Van Life for Beginners: Essential Guide - Source cocovanlife.com

Editor's Note: "Retirement Payouts: Essential Guide For Pensioners" was published on [Date] to assist individuals in navigating the complexities of retirement income. By analyzing and synthesizing the latest information, we have compiled this guide to empower our target audience in making optimal financial decisions.

Through our meticulous analysis, we have distilled the key differences between various retirement payout options. This guide presents this information in an easy-to-understand format, providing a clear understanding of the implications of each choice.

As you delve into the main article topics, you will gain a comprehensive understanding of:

FAQ: Retirement Payouts

This FAQ section addresses common questions and concerns related to retirement payouts, providing essential information to help pensioners make informed decisions.

Oscar's Dilemma With Taxable Income In His Retirement Plan - Source www.marketmedianetwork.com

Question 1: What factors determine the amount of my retirement payout?

The amount of retirement payout is typically based on several factors: years of service, salary history, contributions made to the retirement plan, and the type of plan (e.g., defined benefit or defined contribution).

Question 2: What are the different types of retirement payout options?

Common payout options include a lump sum, periodic payments (annuities), or a combination of both. Each option has its advantages and disadvantages, and choosing the right one depends on individual circumstances and preferences.

Question 3: How can I maximize my retirement payout?

To maximize retirement payouts, it is recommended to contribute as much as possible to the retirement plan, diversify investments prudently, and consider delaying retirement age if feasible. These strategies can help accumulate more savings and increase payout amounts.

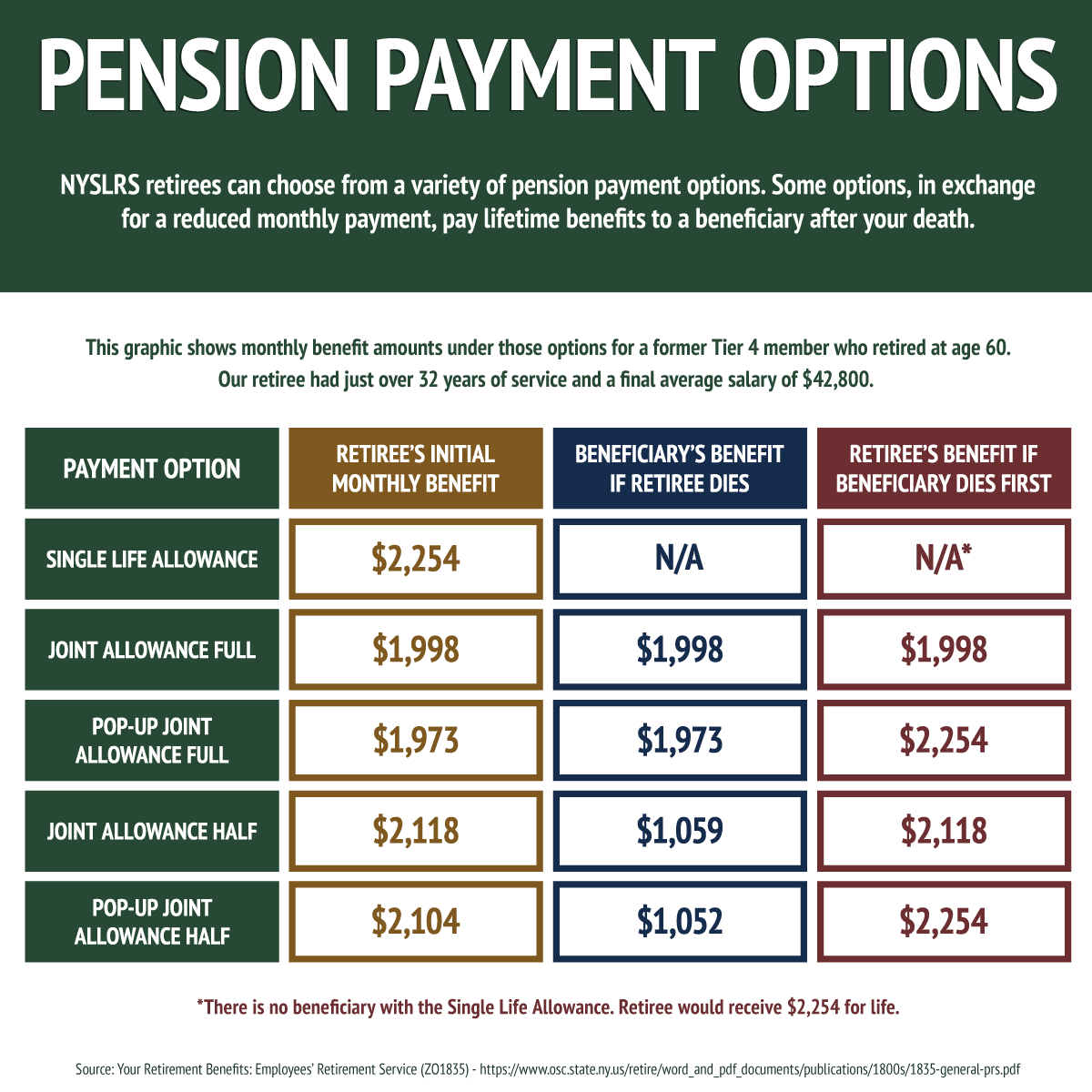

Question 4: What happens if I die before receiving all of my retirement payout?

In the event of premature death, the remaining retirement payout may be distributed to designated beneficiaries according to the plan rules. It is important to review and update beneficiary designations regularly to ensure the desired distribution of funds.

Question 5: How can I protect my retirement payout from inflation?

To protect retirement payouts from inflation, consider investing in assets that are likely to maintain or increase their value over time, such as certain stocks, bonds, or real estate. Additionally, consider a payout option that includes inflation-linked adjustments.

Question 6: What are the tax implications of retirement payouts?

Retirement payouts are generally subject to income tax, and the tax treatment can vary depending on the type of plan and payout option. It is crucial to consult with a tax professional to fully understand the tax implications of retirement payouts.

Understanding these key considerations and seeking professional advice when needed will help pensioners make informed decisions about their retirement payouts.

Transition to next article section...

Tips

To ensure a smooth and secure retirement, it's crucial to plan and manage your pension payouts effectively. Here are some essential tips to guide you through this process:

Tip 1: Understand Your Retirement Options

Familiarize yourself with the various types of retirement accounts available, such as defined benefit plans, defined contribution plans, and individual retirement accounts (IRAs). Each option has unique features and tax implications, so it's important to research and determine which one best aligns with your financial goals.

Tip 2: Plan Your Retirement Income

Estimate your post-retirement expenses to determine how much income you'll need to maintain your desired lifestyle. Consider factors such as your age, health, and financial obligations. This will help you plan a withdrawal strategy that ensures you don't outlive your savings.

Tip 3: Seek Professional Advice

Consult with a financial advisor or retirement planner to help you navigate the complex world of retirement planning. They can provide personalized guidance based on your specific situation, helping you optimize your payouts and minimize tax implications.Retirement Payouts: Essential Guide For Pensioners

Tip 4: Consider a Gradual Retirement

Instead of abruptly retiring at once, consider phasing into retirement by working part-time or consulting. This can help you ease into retirement financially and gradually adjust to a lower income without drastically depleting your savings.

Tip 5: Be Flexible

Recognize that your retirement plans may need to adapt over time. Be prepared to adjust your withdrawal strategy or consider part-time work or volunteer opportunities if your circumstances change.

By following these tips, you can increase your chances of enjoying a secure and fulfilling retirement. Remember to plan early, seek professional guidance, and stay adaptable to ensure you maximize your retirement payouts.

Retirement Payouts: Essential Guide For Pensioners

Retirement is a significant milestone, and understanding retirement payouts is paramount for pensioners. These payouts provide financial security during the golden years, and it's imperative to be well-informed about the key aspects associated with them.

These key aspects provide a comprehensive framework for understanding retirement payouts. By carefully considering these factors, pensioners can make informed decisions, ensuring financial stability and well-being throughout their retirement years. For instance, optimizing investment choices based on risk tolerance and time horizon can enhance retirement income. Additionally, seeking professional advice from financial planners or pension experts can provide valuable guidance in navigating the complexities of retirement payouts and maximizing the benefits they offer.

Certain Payment Options Provide a Lifetime Benefit for a Loved One - Source www.nyretirementnews.com

Retirement Payouts: Essential Guide For Pensioners

This comprehensive guide provides invaluable information for pensioners seeking to understand and manage their retirement payouts. It covers various aspects of retirement planning, including payout options, tax implications, and strategies for maximizing income while minimizing financial risks. Understanding these elements is crucial for pensioners to make informed decisions and secure their financial well-being during retirement.

Guide for urban ropeways - Seilbahnen International - Source www.simagazin.com

Retirement payouts are a critical component of retirement planning, as they determine the financial resources available to pensioners during their later years. By providing insights into different payout options, this guide empowers pensioners to choose the most suitable option based on their individual circumstances and financial goals.

Furthermore, the guide explores the tax implications associated with retirement payouts, ensuring that pensioners are aware of the potential tax liabilities and can plan accordingly. This understanding enables them to optimize their retirement income and minimize the impact of taxes on their savings.

Ultimately, this guide serves as a valuable resource for pensioners seeking to make informed decisions about their retirement payouts. By utilizing the information provided, pensioners can enhance their financial security and enjoy a comfortable and financially stable retirement.

Table: Key Retirement Payout Options

| Payout Option | Description |

|---|---|

| Annuity | A contract with an insurance company that provides regular income payments for life or a specified period. |

| Defined Benefit Plan | An employer-sponsored plan that pays a fixed monthly benefit based on factors like salary and years of service. |

| Defined Contribution Plan | An employer-sponsored plan where the employee and/or employer contribute to an investment account, with benefits based on the account balance at retirement. |

| 401(k) Plan | A tax-advantaged savings plan offered by employers, where contributions are made on a pre-tax basis. |

| IRA | An individual retirement account that offers tax advantages for retirement savings. |