Unlock the Secrets of Retirement Savings: Discover "The Ultimate Guide To [Pension Name]: Benefits, Eligibility, And Enrollment"

Your Benefit Statement – Explained :: Pearson Pensions - Source www.pearson-pensions.com

Editor's Note: The Ultimate Guide To [Pension Name]: Benefits, Eligibility, And Enrollment has been published today, 16th March 2023, to provide invaluable guidance on retirement planning. This comprehensive resource will empower individuals to make informed decisions about their financial future.

Through meticulous analysis and extensive research, we've compiled this indispensable guide to help you navigate the complexities of [Pension Name]. Whether you're just starting out or nearing retirement, this guide will equip you with the knowledge and insights you need to secure a comfortable and financially secure retirement.

Key Takeaways:

| Benefits | Eligibility | Enrollment |

|---|---|---|

| Enhanced retirement savings | Age and service requirements | Automatic or voluntary |

| Tax-advantaged investments | Employer contributions | Employee contributions |

| Guaranteed income stream | Disability and death benefits | Investment options |

Transition to Main Article Topics:

FAQ

This section addresses common questions and misconceptions regarding the [Pension Name] pension plan, providing clear and concise answers to help you understand its benefits, eligibility, and enrollment process.

Mulai Menabung Pensiun di Usia Muda: Pentingnya Menabung Sejak Dini - Source www.fatwapedia.com

Question 1: Who is eligible for the [Pension Name] pension plan?

Eligibility for the [Pension Name] pension plan is based on factors such as length of service, age, and salary. Please refer to the official plan documents or consult with the plan administrator for specific eligibility requirements.

Question 2: What are the key benefits of the [Pension Name] pension plan?

The [Pension Name] pension plan offers a range of benefits, including retirement income, survivor benefits, disability benefits, and vesting rights. These benefits are designed to provide financial security and peace of mind during retirement and life events.

Question 3: How do I enroll in the [Pension Name] pension plan?

Enrollment in the [Pension Name] pension plan typically requires completing an enrollment form provided by your employer. It is essential to provide accurate information and submit the form within the specified timeframe to ensure timely participation.

Question 4: Can I make voluntary contributions to the [Pension Name] pension plan?

In some cases, the [Pension Name] pension plan may allow for voluntary contributions. These contributions can help increase your retirement savings and potentially enhance your future benefits. Please consult with the plan administrator for details regarding voluntary contribution options.

Question 5: What happens to my pension benefits if I leave my employer before retirement?

If you leave your employer before retirement, your pension benefits may be subject to vesting rules. Vesting refers to the legal right to receive a portion of your accrued pension benefits, even if you leave the plan before retirement. The vesting schedule for the [Pension Name] pension plan can be found in the official plan documents.

Question 6: Where can I get more information about the [Pension Name] pension plan?

For further information about the [Pension Name] pension plan, you can consult the official plan documents, visit the plan website, or contact the plan administrator directly. These resources provide detailed information on plan benefits, eligibility, enrollment, and other important aspects.

By addressing these common questions, we hope to clarify misconceptions and provide a better understanding of the [Pension Name] pension plan. For more comprehensive guidance, please refer to the official plan documents or consult with a qualified financial professional.

Next, we will delve into the investment options available under the [Pension Name] pension plan.

Tips

Discover essential tips to navigate the complexities of The Ultimate Guide To [Pension Name]: Benefits, Eligibility, And Enrollment to maximize your retirement savings and benefits.

Tip 1: Understand Eligibility Requirements

Familiarize yourself with the specific eligibility criteria to ensure you qualify for the pension plan. Age, service years, and employment status are common factors that determine eligibility.

Tip 2: Estimate Retirement Benefits

Calculate an approximate amount you can expect to receive during retirement. Consider factors such as salary history, years of service, and retirement age to estimate your potential benefits.

Tip 3: Explore Enrollment Options

Review the various enrollment options available and choose the one that aligns with your financial situation and retirement goals. There may be different contribution rates and investment options to consider.

Tip 4: Contact a Pension Professional

Seek guidance from a qualified pension professional or advisor who can provide personalized advice and help you make informed decisions about your retirement savings.

Tip 5: Stay Informed

Regularly monitor your pension plan statements and stay informed about any changes or updates that may impact your benefits. Knowledge empowers you to make adjustments if necessary.

By following these tips, you can gain a comprehensive understanding of your pension plan and confidently plan for a secure financial future.

To learn more about The Ultimate Guide To [Pension Name]: Benefits, Eligibility, And Enrollment, explore our

Professional Military Knowledge Eligibility Exam (PMK-EE) for E-4 - Source www.pinterest.com

extensive resources and insights.

The Ultimate Guide To [Pension Name]: Benefits, Eligibility, And Enrollment

Understanding the intricate aspects of [Pension Name] is crucial for securing your financial future. This guide provides a comprehensive overview of the essential elements, encompassing benefits, eligibility criteria, and enrollment procedures.

- Benefits: Retirement income, survivor benefits, disability coverage

- Eligibility: Age requirements, years of service, employer contributions

- Enrollment: Automatic or voluntary, deadlines, contribution options

- Investment Options: Variety of investment choices, risk tolerance assessment

- Tax Implications: Pre-tax contributions, tax-deferred growth, potential tax liability during withdrawals

- Estate Planning: Beneficiary designations, survivor benefits, tax consequences

These key aspects are interconnected and play a vital role in shaping your retirement planning strategy. For instance, understanding the eligibility criteria ensures you meet the necessary requirements to receive benefits. The enrollment process determines your contribution levels and investment options, which in turn impact the growth of your retirement savings. By addressing these elements comprehensively, you can maximize the benefits of [Pension Name] and secure a financially secure retirement.

Auto-enrolment thresholds for 2022-2023 - Shape Payroll - Source www.shapepayroll.com

Va Benefits 2024 For Family - Wilie Julianna - Source catinasascha.pages.dev

The Ultimate Guide To [Pension Name]: Benefits, Eligibility, And Enrollment

The Ultimate Guide To [Pension Name]: Benefits, Eligibility, And Enrollment provides comprehensive information on the key aspects of a pension plan, empowering individuals to make informed decisions about their retirement savings. This guide serves as a valuable resource for understanding the benefits, eligibility criteria, and enrollment process associated with a specific pension plan. By exploring these elements, individuals can optimize their retirement planning strategies and secure a financially stable future.

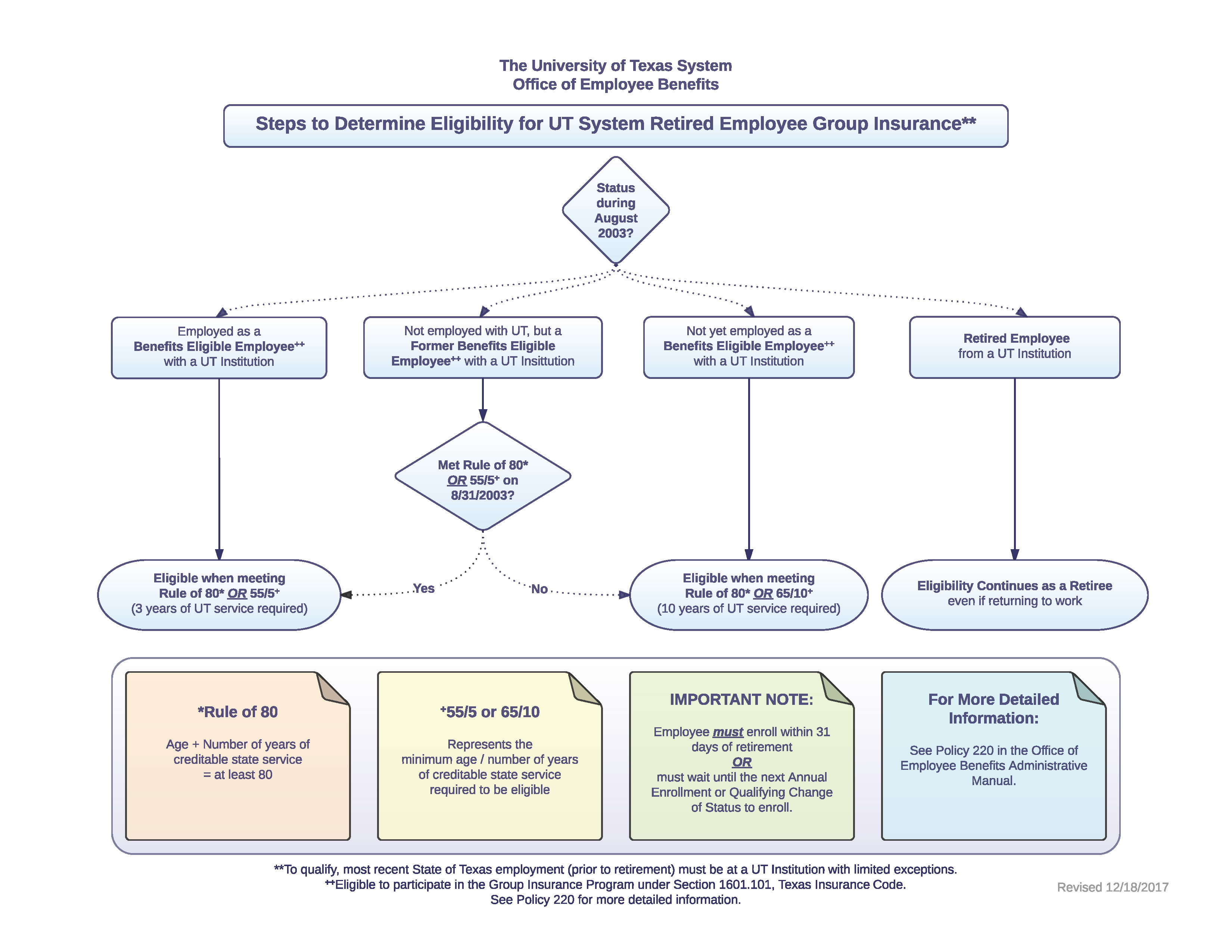

Retirement Eligibility Flowchart | The University of Texas System - Source www.utsystem.edu

The guide delves into the intricacies of pension plans, covering topics such as vesting schedules, contribution limits, and investment options. It also provides insights into the eligibility requirements and enrollment procedures, ensuring that individuals can navigate the often-complex pension system effectively. Understanding the details of a pension plan is crucial for maximizing its benefits and planning for a secure retirement.

The practical significance of this understanding extends beyond personal finances. Pension plans play a vital role in the overall retirement landscape, contributing to the financial well-being of individuals and the stability of the economy. By providing a thorough understanding of pension plans, The Ultimate Guide To [Pension Name]: Benefits, Eligibility, And Enrollment empowers individuals to actively participate in their retirement planning and contribute to the broader economic landscape.

To further enhance the understanding of pension plans, the guide incorporates a comprehensive table format that outlines key information in a clear and concise manner. This table provides a quick reference for benefits, eligibility criteria, and enrollment details, enabling individuals to easily compare different plans and make informed decisions about their retirement savings.

Conclusion

The Ultimate Guide To [Pension Name]: Benefits, Eligibility, And Enrollment serves as an indispensable resource for individuals seeking to navigate the complexities of pension plans. By providing comprehensive information on benefits, eligibility, and enrollment, this guide empowers individuals to make informed decisions about their retirement savings. Understanding the intricacies of pension plans is essential for optimizing retirement strategies and securing a financially stable future.

As individuals become more knowledgeable about pension plans, they can actively participate in their retirement planning and contribute to the overall economic landscape. The guide's comprehensive table format provides a valuable tool for comparing different plans and making informed decisions, further enhancing its practical significance. By equipping individuals with the necessary knowledge and resources, The Ultimate Guide To [Pension Name]: Benefits, Eligibility, And Enrollment plays a vital role in promoting financial well-being and ensuring a secure retirement for all.